SILENT DEPRESSION

Debt Spiral and Breakdown of the American Way

Financial markets are in a vicious cycle. Interest on the national debt is now too large to service. More borrowing is required to pay more interest, and more inflation is required in order to borrow.

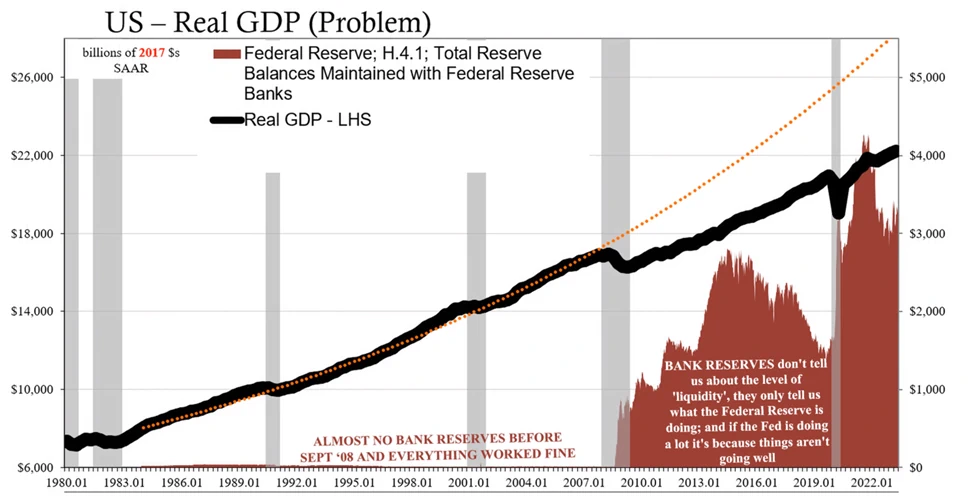

In August 2007 the offshore dollar market exhausted its collateral, and has been unable to finance growth in line with the previous 35 years. In the US, domestic banks also experienced so much collateral destruction they could no longer lend to Main Street in the way in which two generations had become accustomed. The monetary policy response was to increase central bank reserves to induce lending. But excess statutory reserves do not represent economic collateral, and in fact instead represent additional encumbrances on the capital which remained. The consequence has been 15 years of severely below trend growth that the United States has now underperformed similar conditions of the 1930s. At some point, no amount of increase in statutory bank reserves will positively effect lending, and instead so acutely begin working against the solvency of the currency no loans repaid in dollars can be made at all.

Eurodollar University

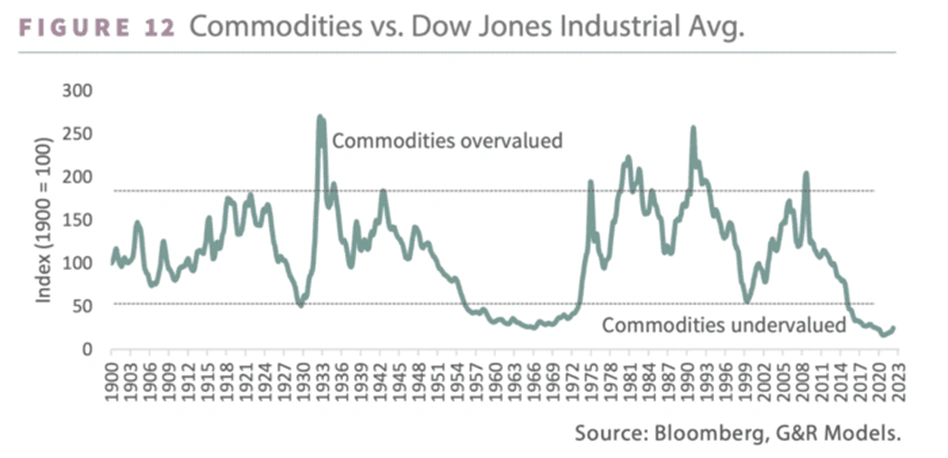

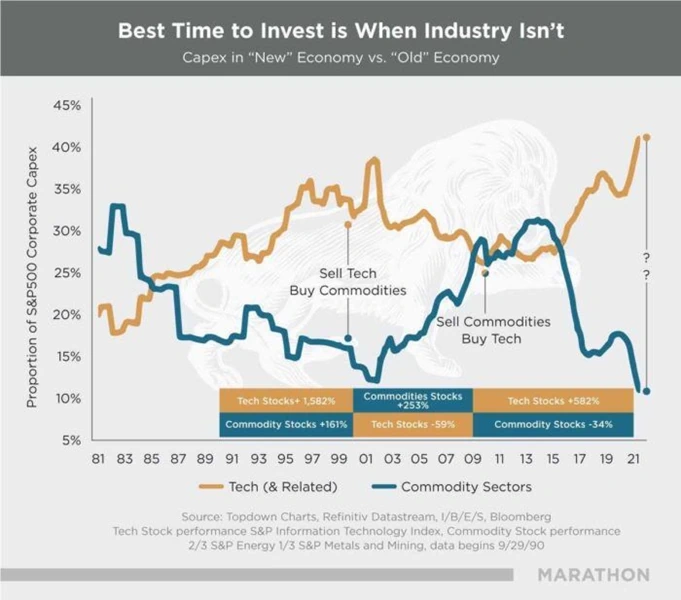

As the US and other welfare state nations struggle to service their bonds, taxes likely rise and bond market financing likely crowds-out and pulls capital from equity markets. Likewise, a downshift in standards of living occurs in the form of an upward-ratcheted increase in commodities prices relative to wage growth and equity valuations. Absent a reliable store of value feature in the monetary system, commodity markets outperform and lead to a general rotation out of bonds and real estate and into commodities and digital assets led by bitcoin.

A portfolio posture that leads heavily with bitcoin, complimented with direct private exposure to critical minerals, gold, and oil & gas, as well as technology to merge those minerals and energy assets into digital assets which generate additional bitcoin-based revenues by facilitating capital investments flows into strategic commodities should broadly outperform. Bitcoin mining is the activity of generating provenance on the Bitcoin blockchain that dilution and censorship has not transpired, which is one such store of value. Similar types of provenance around physical commodities, energy and communications can deliver similar grades of superior collateralizing to new mining development on the brink of absorbing historic capital inflows. The Chinese Communist Party as a peer competitor to the liberal world order owes its survival to coercion, control and extraction, and its collateral shortages are even more severe than those of the West. Any technology provider offering voluntary ecosystems with internally-intact governance and provenance to retain stores of value should benefit from a winner-take-all effect in the New Age.

The Breakdown of the Eurodollar

Macro Monetary Failure and Chinese Growth

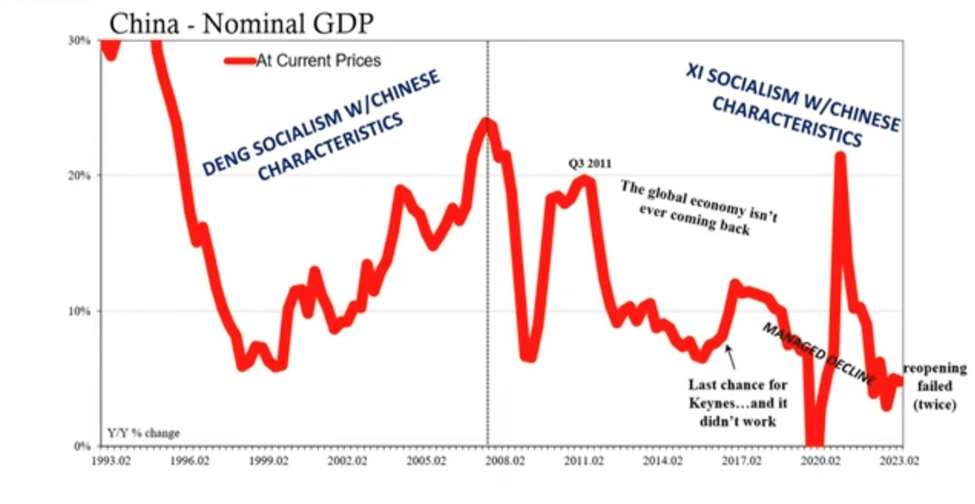

The West’s forfeiture of the ideology of technology growth, entrepreneurship and sound money led to a liquidation of every store of Western collateral, financial, cultural, and technological. As those forms of collateral represent the combined stores of collateral within the eurodollar system, it began to fail in generating global growth. The self-congratulation on achieving a globalized cosmopolitan eschaton have grown quieter. But most acutely this has been felt in China. The Chinese economy is the single most geared to globalization, and as organic growth began to slow, the deficits were made up with new credit on which it has now relied for going on for 15 years. Those credit balances are now so enormous, the world entire cannot generate the GDP to ever retire them.

The door of opportunity has closed on 500 million Chinese people who’ve been left behind. The totalitarian regime whose legitimacy rides on generating growth is now also rolling over and will grow increasingly desperate to siphon collateral out of all the world’s networked systems in order to prevent its own collapse.

Eurodollar University

The CCP’s imperative fundamentally involves the development of a replacement system for the eurodollar network so as to bypass the United States’ access to those same remaining global financial collateral stores. But while the growth of the eurodollar network was organic and at least partially voluntary, the CCP’s network must be contrived, extractive and coercive. The CCP’s mafia syndicalism and pyramid structure is being extended over dozens of other countries around the world. While this is occurring hand in hand with black bag diplomacy, Western entrepreneurs and capital allocators to a shocking degree exaggerate the power of the depleted eurodollar system and its capacity for influence. The blindness of high-trust societies assumes a parochial reliance on foreign markets’ intrinsic rule of law and political stability, while its low-trust adversary has no such presumption. The result is a rapid ceding of trade, telecommunications, commodities, and capital-access networks on which the old global American Order rested. The gambit of this Order was that foreign nations would absorb the chronic trade and government budget deficits the US government orchestrated so American citizens would not bear the full burden to finance their own metastasized welfare state or defense budgets. The Chinese approach to unraveling this global network and surreptitiously insert a network of its own has been subtle and resembles the game Weiqi (“Go”): the US capacity to export its deficits has been encircled and cut off.

Macro Regime Change

From Intangibles to Tangibles and the Case for Energy and Strategic Minerals

“I took the money, I spiked your drink

You miss too much these days if you stop to think,

You, you were acting like it was the end of the world.”

-U2

Russia’s invasion of Ukraine illustrated the limitations of the 50-year regime in American central banking where the solution to any market turmoil was to lower bond rates and extend average maturities. While the US cut off Russian banking from SWIFT which marked down the ruble by 55%, the USD was still down more than 55% against oil.

This illustrated that US dollar hegemony only extends as far as its capacity to ensure global trade of prime commodities and that the petrodollar is a more vital element of the eurodollar system than has been appreciated in decades. Meanwhile, the seizure of Russian USD Treasury reserves by the US Fed communicated to major overseas buyers such as China that US debt can no longer be treated as “risk free.” This moment was more historically powerful than the 1971 severing of the US dollar from gold. Trust on which central bankers so preciously rely is fundamentally lost. The knock-on effect that the Fed’s capacity to export inflationary pressure is not only far more limited than it likely believes, but that it can no longer take credit for the 40 years of soft inflationary conditions which instead occurred despite its rampant interventionism.

Meanwhile, the ruble, despite Russia’s gov’t debt default , functioned far more like a bellwether in at once being tied to commodity wealth and also was less penetrated by Western financialization. As such there is a sense in which it is a more meaningful proxy for the basic industrial productivity inputs required in greater measure in a rising rate environment.

This move of the ruble and the washout in cryptoasset leverage marks the end of the 40-year bull market in bonds and financialization which spurred globalization in every asset class. It also marks the beginning of a secular inflationary regime tied to an unwinding in the American-led global order, reflecting commodity scarcity, regionalism and even localism in industrial capacity. Many nations are now beginning to stockpile food, precious metals and energy . Prices of energy, agricultural commodities, critical minerals and manufactured products can no longer be hidden under financialization, reductions in bond coupons/extensions in maturities, and a growing Chinese population flooding the global labor pool.

The peaking of the Chinese population itself and China’s trade edge as the low-cost producer, already undermined on multiple fronts, will compress as its demographics shrink drastically. Meanwhile, acquisition multiples on renewable, low-cost, geographically-independent energy assets will also continue to elevate in the coming decade, partly spurred by state-sponsored investment in renewables, and especially in supplying low-cost baseload power to developing markets targeted by China’s Global Development Initiative.

When nations bound to a gold standard experience trade deficits, gold flows overseas. When their currency is bound to industrial capacity, that capacity is liquidated and reconstructed overseas. As the capacity of the country to use financialization to perpetuate trade deficits hits its lower bound, this trend reverses, also forcing a reshoring of manufacturing to the degree organic demand supports it. However, the regime of financialization responsible for hiding the original costs of capacity liquidation must also be reconfigured to account accurately for the increased sensitivity toward economic competitiveness. Simply, this translates to a US dollar weakening against all commodities and consumer products. As the excesses of the financialized world unwind, transparent, double-spend free money and digitally-non-intermediated contracts will outperform. Especially where energy and critical minerals are concerned: networks driven by those with the energy are in control, those doubling down again on financialization and centralized ledgers are losing control.

To be continued…

-RC

The Geopolitics of Bitcoin – Part I

The Geopolitics of Bitcoin – Part III

The Geopolitics of Bitcoin – Part IV

The Geopolitics of Bitcoin – Part V