The Aperture of Uncertainty

Undercollateralization of Commodities Markets

The single most important driver of bitcoin demand we believe will be large sovereign funds responding to the eurodollar and US Treasury markets trending in a direction of far less stability over the next decade. Blackrock president Larry Fink declared on 10/16/23 that a false rumor of Blackrock’s ETF approval and price spike constituted a “flight to quality.” Blackrock will likely spend over a billion dollars to promote its ETF to sovereign funds and asset managers, ratcheting the narrative to new institutional levels.

Tactical trading or positions which last under a year are clearly not driven by these dynamics. But financial reserve allocators have horizons of 10-20 years. The marginal decision to hedge by major sovereigns against the widening aperture of uncertainty brings with it enormous financial volume which can easily quintuple the Bitcoin market cap over the next 15 years, and likely much higher. This uncertainty dynamic carries with it a hard lower bound: the USD as the primary global commodities trading medium. The ongoing currency war is a more of a commodities war than the era of financialization has allowed us to appreciate.

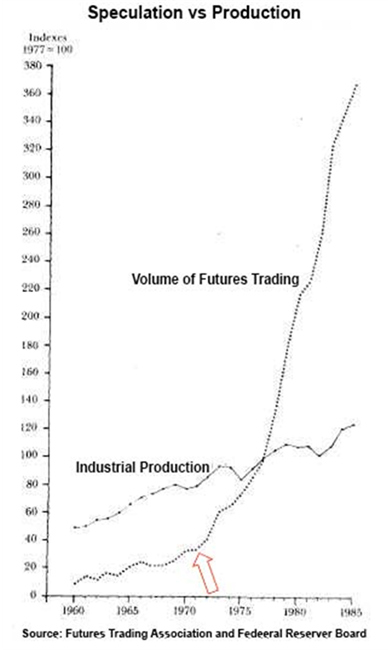

Global commodity markets have become highly financialized, leveraged and fragile. The Commodity Futures Modernization Act of 2000 facilitated the amount of open interest in the commodities market to grow from around 20% to 80-90%, representing an explosion in financial speculation as the primary driver of commodity pricing. The market has become increasingly concentrated with a handful of dominant commodity trading houses (e.g., Trafigura, Glencore, Vitol, Unipec, etc.) that all finance their highly leveraged operations through central clearing counterparties (CCCs). The purpose of these CCCs is to mutualize credit risk among member institutions. But these entities employ highly concave “Value-at-Risk” models with short historical data sets (5-10 years) in establishing initial margin requirements – they are undercollateralized and also highly-sensitive to volatility.

These models were not trained for convex scenarios, such as those emergent in the last 3 years. As examples, the world’s largest commodity exporter (Russia) is hit by coordinated G7 sanctions and an insurance blockade on shipping, or where the world’s largest goods producer (China) shuts down its factories and ports in waves of COVID-19 lockdowns. The result has been, and will continue to be, wild swings in commodities markets that threaten to bankrupt commodity trading houses (e.g., Trafigura), question the solvency of CCCs and force potential bailouts. Moreover, these CCCs have unlimited recourse to the balance sheets of their members (namely, global systemically important banks, G-SIBs) to keep themselves solvent in a liquidity event. Nationalizations (or quasi-nationalizations) aren’t off the table, especially as China’s state-owned trading house (Unipec) is poised to take market share in the geostrategically critical (and deeply murky) commodity markets.

It is important to note that it is these very same G-SIB balance sheets that are supposed to absorb securities rolling off of central bank balance sheets (via quantitative tightening) and to absorb increasing U.S. Treasury issuance. These G-SIB balance sheets, while nominally attached to private banks, function in the post Basel-III environment as public utilities; that is, they exist as effective extensions of the central bank and are captive agents to facilitate the financing of the sovereigns by whose remit and legal mandate they exist in the first place. Thus, there could come a point where the increasing volatility and financial stress from geopolitically disruptive commodity markets encumbers the ability of banks to support off-balance sheet financing of their fiscal authorities.

The core US interest is global (relative) hegemony, even at the cost of growth. US debt monetization for massive embedded obligations and flooding USD into the system, with all its collateral cannibalization and inflationary pressure also directly targets the CCP in its commodity-reliance. Meanwhile, the CCP sees this as an opportunity for a monetary “zugzwang” to redirect it back to the West (e.g., Urals crude at $50, Brent at $200…), in order to blow up large, highly-leveraged commodity trading house competitors in physicals trading.

The Russian invasion exposed the power of the SWIFT system as a major component of the strength of the USD as inferior to the petrodollar and commodities wealth trading component within the USD. But furthermore, global commodities market clearing and trading is riddled with dark leverage and outdated by analog architecture and delivery. Major trading firms need opensource, transparent governance and distribution rails to thrive in an industry on the brink of even greater supply chain and geopolitical disruption.

Commodities and energy need a new transnational governance and tokenization architecture to protect market functionality as a US-sponsored global order disassembles and the geopolitics of commodities transfers higher market volatility into other sectors. This architecture will unlock new producing regions and provide development capital for marginal producers in a fashion not controllable by individual nation states to smooth out access and delivery in a multipolar world.

The USD and SWIFT system as deployed to facilitate the global commodities trade is on its way out. The most effective replacement which also offers to help stymie the development of a replacement system controlled by the CCP are decentralized bitcoin-based Web3 ecosystems which can extend uniform governance, project opportunity sourcing, reputation, capitalization sourcing, and provenance to global users, while allowing tokenized, democratic access to commodity wealth, functioning to conjoin both resource value and the value of specialized production skill into a permanent digital ledger architecture, all supported by sound, incorruptible money.

How does the world reconstruct trade networks in a post-American order without using payment rails which can be seized? Not only are global commodity markets deeply murky, they are also not nearly as liquid as speculative trading volumes seem to indicate. A rollback in the American-order standardization and the off-market transactions of state actors like Unipec moving deeper into unforgiving markets deeply illustrates the need for the application of a new, transparent, sound governance-driven, bitcoinized Web3 architecture to facilitate a new and improved global commodities architecture.

Collateral Growth in a World of Repression and Collapse

Commodity-backed “Stablecoins” as Democratic Crossborder Payment Rails which Promote Collateral Growth in a World of Collapsed Collateral

The United States in effect weaponized the US dollar against Russia as it has done to lesser degrees in the past and will continue to in the future. The SWIFT system uses a depleted eurodollar as the ammunition. The retracement of the ruble’s 55% sell-off within weeks had it strengthened against the dollar underscored the reality that defense analysts can no longer ignore.

Money represents a constellation of tools, all vested in one instrument. But chiefly, it is a medium exchange and a store of value. Governments’ primary means of finance is the act of severing these two functions into separate instruments. Rampant currency printing destroys the store of value aspect of money, even if the medium of exchange aspect still obtains.

The severing of the store of value feature from publicly-sponsored currency has destroyed its trustworthiness and created global economic models based on rent-seeking at the expense of capital formation. Its perpetuation has surreptitiously liquidated vast amounts of economic capital as well as social, technological/scientific and cultural capital. Drastically underreported and falsified capital shortages will result in more aggressive inflation, higher interest rates, slower growth, lower innovation, malinvestment-driven busts, military conflict and an upward regime shift in financial and economic volatility.

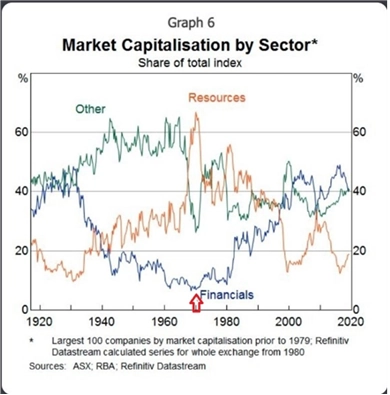

The US dollar and the strength of the SWIFT system are an artifact of the medium of exchange only. The violence of the US Navy and the use of the dollar in exchanging global commodities represent a stand-in proxy for a store of value. This coercive apparatus is unwinding globally, ceding to and being outcompeted by a CCP civil-military fusion approach to commercialization and economic power which bypasses high short term returns for the sake of positional advantage. But it is not short vs. long-term thinking, it’s the difference between investment (collateralization) and rent seeking (de-collateralization). Fundamentally, the existing eurodollar system is configured only to facilitate rent seeking but not investment, wherein the cannibalization of capital/collateral is not just inevitable, it is by design.

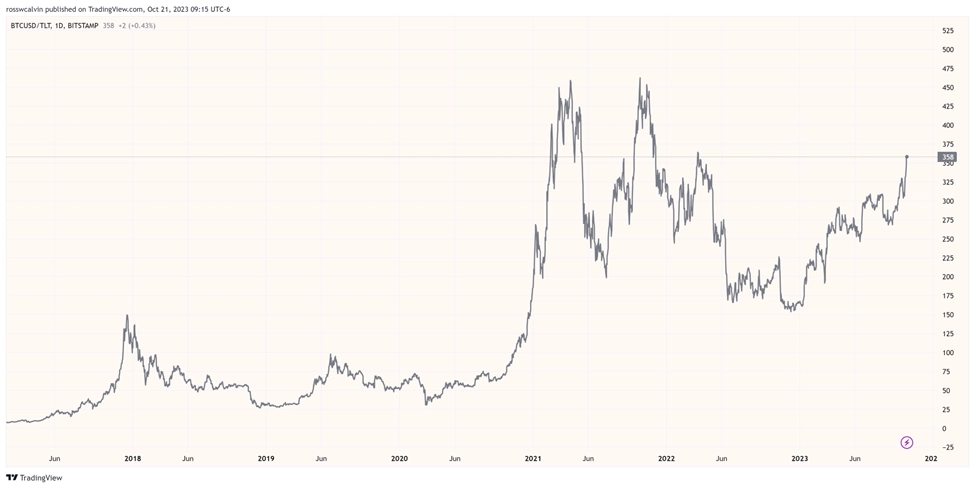

Relative outperformance of bitcoin vs. US bonds: Long Bitcoin – Short 20yr US Bond ETF

Moscow in that moment wagered that the store of value as represented by its hydrocarbon supplies was the more powerful of the two monetary elements. And they were correct. The strategic value of energy as a store of value is more powerful than the strategic value of the SWIFT system in global payment settlement.

The US dollar is a tool of the US Defense Department, but this weapon system is in need of a monumental upgrade.

China’s Belt and Road Initiative, recently renamed the Global Development Initiative for political correctness in the global south, attacks this reality full steam. The free world funded the creation of a Leninist manufacturing apparatus which is now in the position to dominate all vectors in the store of value matrix.

This has been accomplished through black bag diplomacy and a willingness to deal with regimes with whom Western firms and private capital are prohibited from or unwilling to deal. Ironically, none of these regimes compare to the communist regime in Beijing in terms of natural rights violations and regime brutality. This of course puts the lie on the idea of sponsorship of globalization by the American state and private capital, who, in fact, today prove far too parochial to understand the scope of what is necessary to preserve the financial standing of the US currency, financial markets and technology/communications networks. And this where the enormous opportunity lies.

In addition to Chinese capture of the vast bulk of global energy minerals, and the majority of other critical commodity inputs around the world, China has built a digital currency transaction network with higher throughput and lower latency than the SWIFT system, to integrate a store of value in some ways superior to what is offered through the eurodollar, and with a technologically superior medium of exchange rails to what the US can provide.

In a world which has failed to innovate for nearly two generations, in which Western entitlement spending and commodity-currency-motivated warfare has so destroyed public finance and currency viability, and in a world where China’s extreme metastasis of unpayable credit created to sponsor communist party syndicalism, the world is left more deeply short of collateral then at any point since the fall of Rome. The warfare of the next 25 years will be fought over and who controls the remaining collateral, and therefore which regime will survive.

The experience of market over the last 40 years is no longer applicable and markets have entered a new paradigm. We are out of the context of the past. The 40 year channel in interest rate suppression is broken. Did any high yield bond in this period ever mature, or were did they default or were refinanced? Never paying debts in full cannibalized systemic collateral. Default rates will be higher and recovery rates will be lower than at any other time.

End of a paradigm: Breakdown of rate suppression on US debt

Control of remaining collateral must be predicated on a system which offers the most value to the most people. This means open source, not censorship-ridden. This means transparency and trustlessness, not state violence and bribes. This means high throughput. This means capacity to support private capital formation precisely in many untapped and underrepresented parts of the globe. This means such high universality that local cultural norms can be supported not bulldozed. This also means precisely that government or central bank issues are valueless.

The growth in stablecoin volume and superior payment rail technology is critical to this system upgrade, but not sufficient. Stablecoins simply import the offshore dollar market into a digital housing. They do not solve any collateral shortage.

The Western way of life should not be dependent on counterfeiting as the means of debt avoidance. Pride in our constitutional republic should repudiate public counterfeiting. The American Revolution was fought, primarily to overthrow The Currency Act perpetrated by King George III, although even by 1791 the financial apparatus had been co-opted by groups which did not possess Western or American values. A nail in the coffin would be the tithing to a Leninist regime in China as its currency system comes to dominate the collateral stores of global mineral wealth where it already controls such manufacturing capacity.

The monetary store of value is comprised of two major elements, basic resources and productivity agents (labor + capital assets + technology). Downstream industrial applications are beyond our current scope. However, owing to these geostrategic tensions and the ultimate strength of US fiscal operations versus US monetary policy, we believe we are on the brink of another global commodity super cycle. Capitalizing on this super cycle while engineering a technology ecosystem to restore and harden collateral within a voluntarism-forward architecture is what this moment calls for. Defense policy through technology-enabled, technology-governed economic opportunity.

To Be Continued….

-RC

The Geopolitics of Bitcoin – Part I

The Geopolitics of Bitcoin – Part II

The Geopolitics of Bitcoin – Part IV

The Geopolitics of Bitcoin – Part V