Bitcoin mining is capital intensive. However, capital allocation approaches driven by a direct comparison between the higher average total cost of mining vs. lower average total cost of traditional software development reflect incorrect thinking about the respective tradeoffs. Allocation approaches geared toward capturing the returns from the single vector of aggressive scalability of zero-marginal cost software alone are extremely skewed by survivorship bias, and suffer both from high failure rates and the drastic overstatement of ultimate size of addressable markets relative to that of mining. Meanwhile, higher visibility around the drivers of Bitcoin mining returns, misapprehension about the nature of Bitcoin mining plant and equipment CAPEX, and the chronic understatement of wholesale transformation to be reflected in Bitcoin’s long-run market capitalization demonstrate investments in low debt-to-cap Bitcoin mining opportunities to be more precise expressions of strategic exposure to aggressive scalability.

Software Platform Scalability and Zero Marginal Cost

Highly-scalable software-development-only exposures generate returns based on zero marginal cost (ZMC). However, those outcomes by nature depend on narrow value propositions, with limited users and niche business cases. Not all problems solved by apps have equally important but adjacent problems to also solve. The more a given software solves for, the less scalable it must be. Of course, the ultimate scale of addressable market is also necessarily smaller than that of the monetary base layer. Bitcoin’s value proposition is global and driven by factors endemic to the monetary system, the single most highly scaled economic phenomenon. So while the internal marginal cost of scalability is ostensibly higher in non-CAPEX-heavy businesses, total addressable market is far lower. Bitcoin’s total addressable market will be magnitudes larger than any discreet software platform addressing niche markets, even Bitcoin Layer 2 apps.

The volume of rotation out of legacy monetary instruments and into BTC will drastically surpass adoption in the vast majority of niche software apps. To surpass this volume of adoption by a software-only application, the high/low CAPEX comparison cannot be made to the average software business, but cherry-picked against the 10-15 top VC unicorns of the last 25 years. Headline companies which delivered high return multiples did so through ubiquitous saturation have all been centralizers and all near-monopolies. However, for these companies, the vector of ZMC which allows scalability and ubiquitizing centralization must still remain internalized and within the company’s control over decades to finally achieve this position.

Yet, there has been no greater trade on ubiquitous saturation and centralization in history than Bitcoin. It is a totalizing force across every domain of human life, even if this is generated by decentralized and independent providers. Miners, in other words, generate exposure to the same vector of ubiquitizing centralization by externalizing control and never bear the burden of defending a monopoly-like position. In this sense, miners are the single most scalable business in history: that is once Bitcoin is discovered, the miner possesses zero-marginal cost gains in perpetuity. Even the energy cost of the Bitcoin network falls over time through a competitive race to the bottom in ASIC manufacture.

High Failure Rates and Investment Approach Degradation

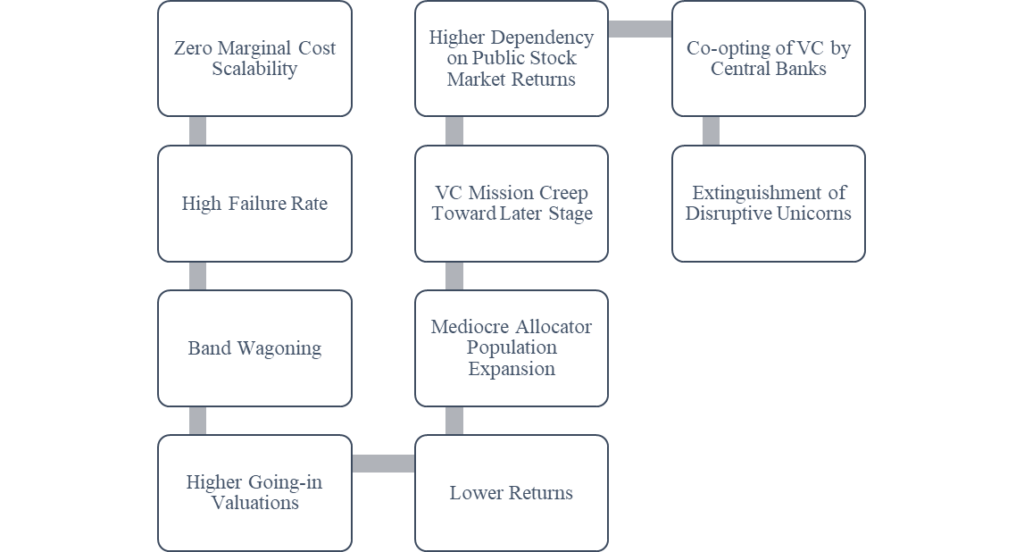

Because materializing on the feature of radical internal scalability is extremely rare it almost completely dissolves the purchase of this vector of decision making. An honest comparison of niche high-scalability software platforms must also be discounted by the failure rate in the subclass itself, which is easily above 99%. Even a position returning 20,000% – a 200x multiple – discounted appropriately is only a 2x return. What about a risk-adjusted return on a 20x multiple, a figure still exceptional in VC history? Generously quintupling the odds to a 5% hit rate / 95% failure rate yields a final return of 1x on a prospective 20x multiple position. Breakeven. A scattershot across hundreds of “scalable” companies hoping one will become Thiel’s position in Facebook is a confession of both cluelessness and underlying fear around the basic proposition of venture allocation. And what do we call an allocator with a shot at a Facebook seed round who also doesn’t know to put their whole fund against it? Worse still, in order to soften the impact of a high failure rate, allocators most often cede their obligation to take positions of high conviction in favor of positions in already-funded companies. An inverse, “scale-down” effect ensues:

Allocations to these companies on the basis of scalability alone lead to approaches resembling buying lottery tickets. Bitcoin miners, however, already possess demonstrable profitability allowing allocators to avoid the decision-making traps associated with high failure rate, niche software development allocations, allowing higher-confidence exposure to the scalability vector without needing their fellow allocators for cover.

True Nature of BTC Miner CAPEX and the Illusion of Alpha

Bitcoin miner CAPEX should not be thought of as traditional CAPEX. 75% or more of miner PP&E is ASIC machines. ASICS are consumed for Bitcoin in the mining process at a rate of 3:1 – they facilitate buying a Bitcoin for 33% of the cost. With immersion, this figure can fall to 5:1 or 20%. Mining hardware is merely representative of lower Bitcoin acquisition costs, which in turn represents even greater scalability. Mining hardware is more of an expense on a semi-durable than a capital investment in durable PP&E. The miner expense is set against SG&A expenses on direct labor hours from small group of people who are unreliable and potentially prone to replacement by AI. Strangely, the high-scalability, pure SG&A approach must heavily rely on the genius of a few targeted individuals. Meanwhile in our cognitive bias we often underestimate the genius and imagination of others across humanity in its whole.

Bitcoin mining hardware reflects the purchase of a perpetual call option (zero time decay) on the labor/productivity of every person and every capital asset in the world.

Targeted exposure to individual geniuses can be thought of as part of a discreet VC mandate in generating alpha. Meanwhile, exposure to worldwide productivity growth is beta by definition. However, climbing the S-curve of platform adoption still requires beta-style validation from fellow allocators before the mass market effect and ZMC profitability are achieved. This indicates that not only must individual genius be identified and allocated to ahead of all others to capture alpha, they must also be priced at aggressively higher multiples than the market does in order that the funding runway be long enough to reach the subsequent round.

An allocation to mining, on the other hand, is a far more precise expression of alpha because Bitcoin succeeds when valuations on systemic credit-based currency unravel – the single expression of counter-market explosive payout and negative correlation.

Leverage to Narrow Customer Base vs. Leverage on the Global Economy

Bitcoin miners bypass the need for radical internally-generated scalability by producing and levering to the most highly scalable asset in history. The comparably lower scalability of a balance sheet high in PP&E is more than subsumed by the near-infinite economic scalability of Bitcoin blockspace. Add to it that Bitcoin miners do not suffer from the need to prove product-market fit, business models, the plausibility of revenues, etc., and thus don’t suffer the extremely punitive discount rates derived from the historical failures in VC when allocating to the vector of scalability alone. If Tim Draper’s price call of $250k is met within the five years, all else equal, a miner’s balance sheet today will be comprised of 80%+ Bitcoin produced at between 20% and 33% of the cost of buying Bitcoin outright. That is, a balance sheet once thought of as CAPEX-heavy will be almost entirely comprised of infinitely scalable assets.

Banking and the Infinity of Credit

The magnitude of global macro forces coalescing on the Bitcoin/USD exchange rate is the central element of the reworking of humanity’s first genuine financial re-engineering in 500 years. Moving out from underneath a financial system of pure credit, all of which is in the process of defaulting with 100% probability, means that any credit default protection should be priced at 100% of global asset values minus the time to maturity discount. ~$380trillion. Today’s Bitcoin market cap is ~$530billion, meaning 0.1395% the global asset base. A market price which reflects something like 1/700th of its appropriate value. Moving into a financial system with Bitcoin as the base layer means a system of pure equity-based collateral.

Speaking generously, the credit-based currency grew to facilitate the naturally low velocity carrying factor of precious metals. To stay alive, however, central and commercial banks are chronically desperate to attract more borrowers to the point of utter global debt saturation, chronically desperate to prevent the real economy from re-collateralizing, even while themselves failing to expand credit fast enough to refinance debts coming due because of a lack of high-quality collateral remaining in the system! A purely credit-based financial system requires constant infusions of equity collateral all the while consuming that dwindling collateral at a faster and faster pace. Preventing debts from final settment in equity is the survival strategy for a banking cartel. And what is money but the final commodity in exchange?

This feverish prevention of debt settlement has driven financial system and monetary fragility to all-time highs and the contortion has infiltrated every layer of abstract capital as well, inverting the purpose of all things as a “tail-wagging-the-dog” means to facilitate more credit growth. Abstract forms of capital like the Constitutional order, integrity of citizenship, engagement of local business, intactness of family, the moral sovereignty of the individual, God-given gender strength, the spiritual community, psychological and meta-cognitive integrity, are all hated and targeted by friends/dependents of the cartel in order they be less resistant to further mortgaging. Degradations in every public institution – the military, the DoJ/FBI, higher education and even K-12, elections, Supreme Court, the healthcare system and global virus prevention – follow suit. Today, all such institutions principally exist only that they be collateralized for the next contrived pretext for gargantuan credit and inflation impulses. Restoration of these forms of capital represents more alpha than any niche software platform could offer.

Scalar Effect

Settlement of transactions for equity in place of an even greater hyper-saturation of credit is what humanity screams for, not just for corporate and household balance sheets, but for the intactness of civil society. A purely equity-collateral backed money of infinite velocity transforms every feature of human life. Bitcoin is the epitome of scalar effect – the transformation of microscopic effects into macroscopic effects, in everything humans touch. It obviates the need for credit-based currency and all its malignancies. Furthermore, central and commercial banks offsetting of naturally falling prices with inflation ensures that prior to the date of Bitcoin’s ubiquitous global saturation the global asset base will certainly be higher than $380trillion.

The eventual growth of the Bitcoin market cap to even 50% of today’s global assets, $190trillion, represents a return on Bitcoin of 35,849%. A miner’s capital assets producing Bitcoin at 3:1 generates an end state return of ~107,500%. A risk-adjusted probability of 1% mirroring historical ability for VC to back immensely-scalable unicorns, one arrives at a 10.76x multiple on capital allocations to Bitcoin miners. Conservatively, at a Bitcoin market cap of 10% of global assets, $38trillion, a Bitcoin price of ~$1.8million, and a 10% allocation success rate, one arrives at a 21.5x multiple. The crypto ecosystem is 15 basis points of the entirety of global assets, rising to replace the entirety of a growing M2 money supply. In a world of rapidly failing trust in government and banking, no hypothesis about the genius of this or that person is needed to generate convex alpha. Allocators can no longer think of scalability in such parochial and myopic ways.

-RC